http://fwd5.wistia.com/medias/lzo1ueniib?embedType=iframe&videoFoam=true&videoWidth=640

As you’ll see in the video, the lenders consider your debt-to-income ratio, which is a comparison of your gross (pre-tax) income to housing and non-housing expenses.

Non-housing expenses include such long-term debts as car or student loan payments, alimony, or child support.

According to the FHA, monthly mortgage payments should be no more than 29% of gross income, while the mortgage payment, combined with non-housing expenses, should total no more than 41% of income.

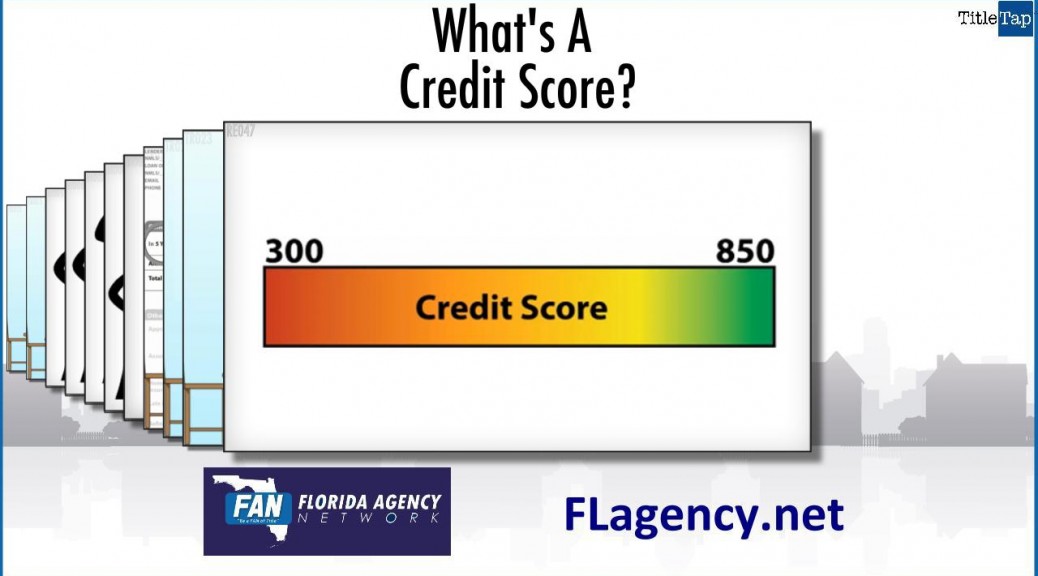

Lenders also consider cash available for down payment and closing costs credit history and the rest of your financial picture when determining your maximum loan amount.