The TILA-RESPA rule (TRID) is proposed to go into effect this year on October 3. Buyer’s Agents will need to be aware of 3 main things: what type of loan product their client is using to purchase, the expected closing date and if their title partner is approved to do business with their client’s lender of choice. This is especially true when it comes down to writing the contract.

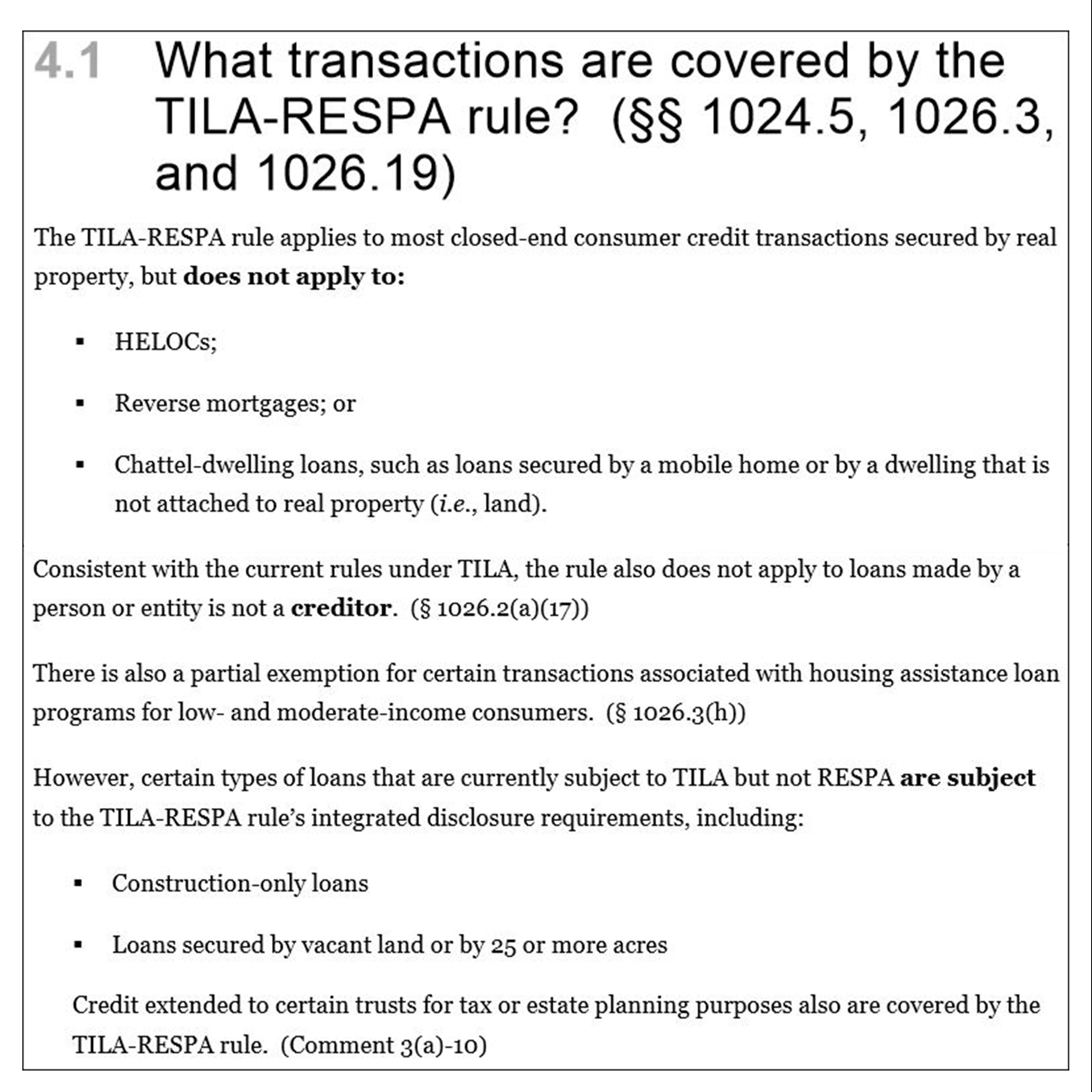

Not all Transactions are Covered by the New Rule

Not all Transactions are Covered by the New Rule

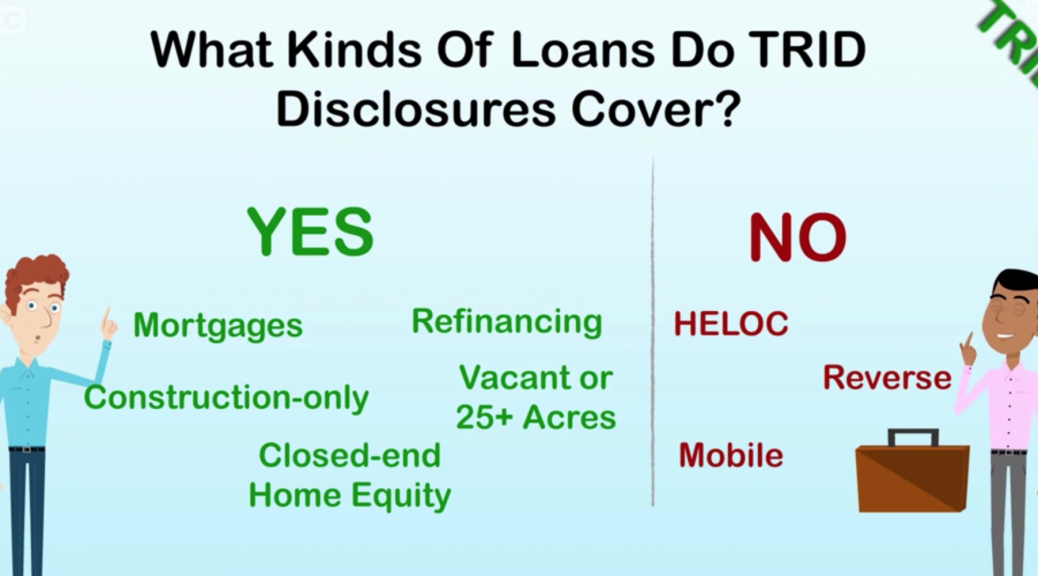

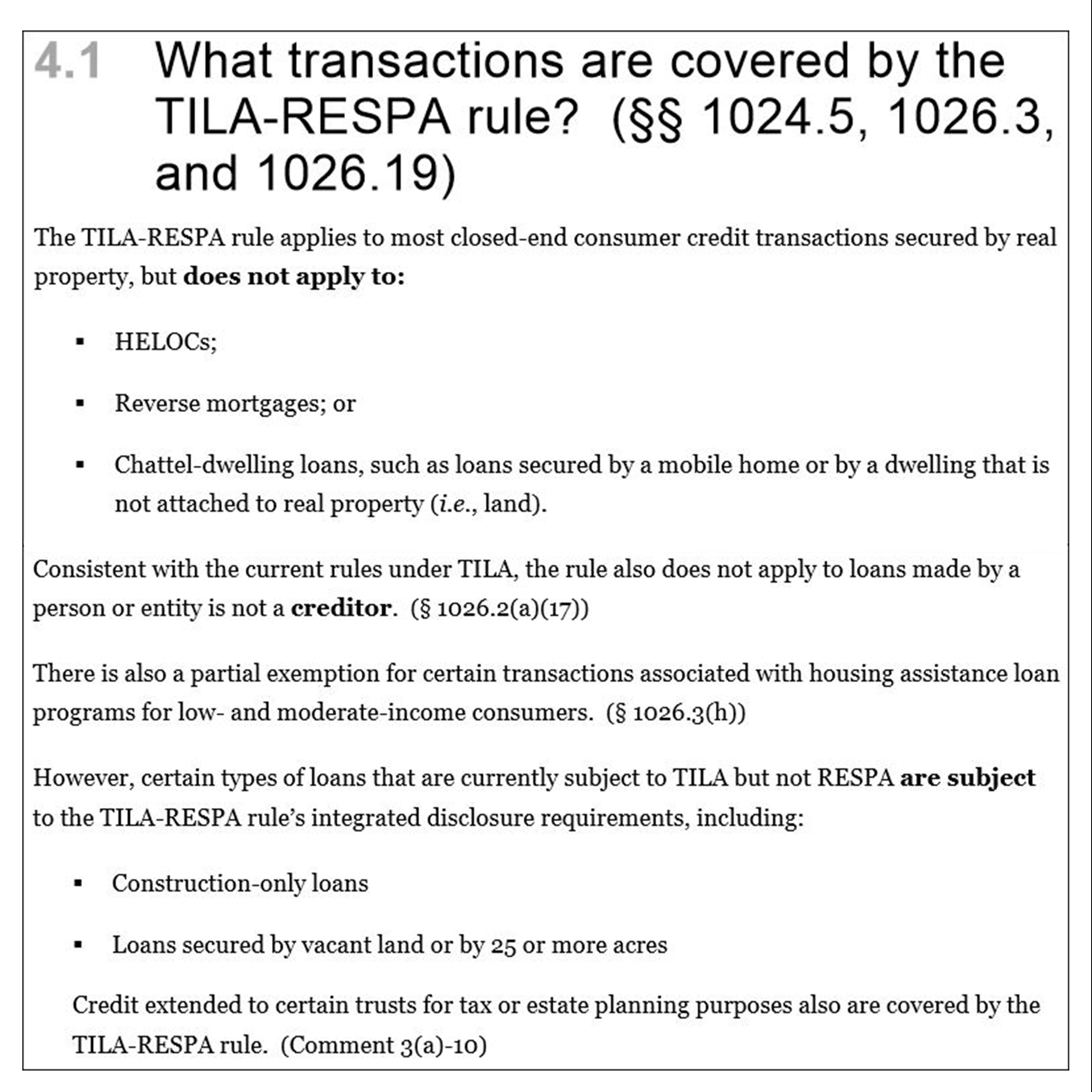

Most closed-end consumer credit transactions that are secured by real property are covered by the new rule.

Certain types of loans that are currently subject to TILA but not RESPA are subject to the TRID rule as well, such as construction-only loans, loans secured by vacant land or by 25 or more acres and credit extended to specific trusts for estate planning purposes.

TRID will not cover HELOC’s, Reverse Mortgages or Chattel-dwelling loans. Other exemptions include loans that are made by a person or entity that makes five or fewer mortgages in a calendar year. In addition to, housing assistance loan programs for low- and moderate- income consumers are partially exempt.

It’s All About Timing

The typical timeline of the closing process is going to change not only in the form of new documents and disclosures but on the operational side of things as well. It will take some time for the industry to adjust to these changes. Just after the rule goes into effect, it is recommended to add on an extra 15 days to the closing date when writing the contract. Eventually, as the industry adjusts, the forecast predicts this will move us to a more paperless environment resulting in an even quicker closing timeline of less than the typical 30 days in Florida.

Is Your Title Partner Approved to do Business With Your Client’s Lender?

Is Your Title Partner Approved to do Business With Your Client’s Lender?

Security is the main issue in regards to compliance between Title Agencies and Lenders due to the obligation both parties must protect Non-Public Information (NPI) data that is exchanged during a transaction. Lenders cannot do business with agencies that do not have compliant software to protect NPI. Technology has a big role in securing data. In an effort to comply, Agencies in the Florida Agency Network use SoftPro to secure the communication of NPI. You can find SoftPro on the American Land and Title Association’s Elite List of 12 Providers that can assist with compliance.

It is best to work with a preferred title partner that is compliant to ensure the least amount of hicups at the closing table. FAN has multiple agencies in our network that are ready to take on these changes. To find an agency in the network near you visit www.flagency.net or contact Max@FLagency.net.

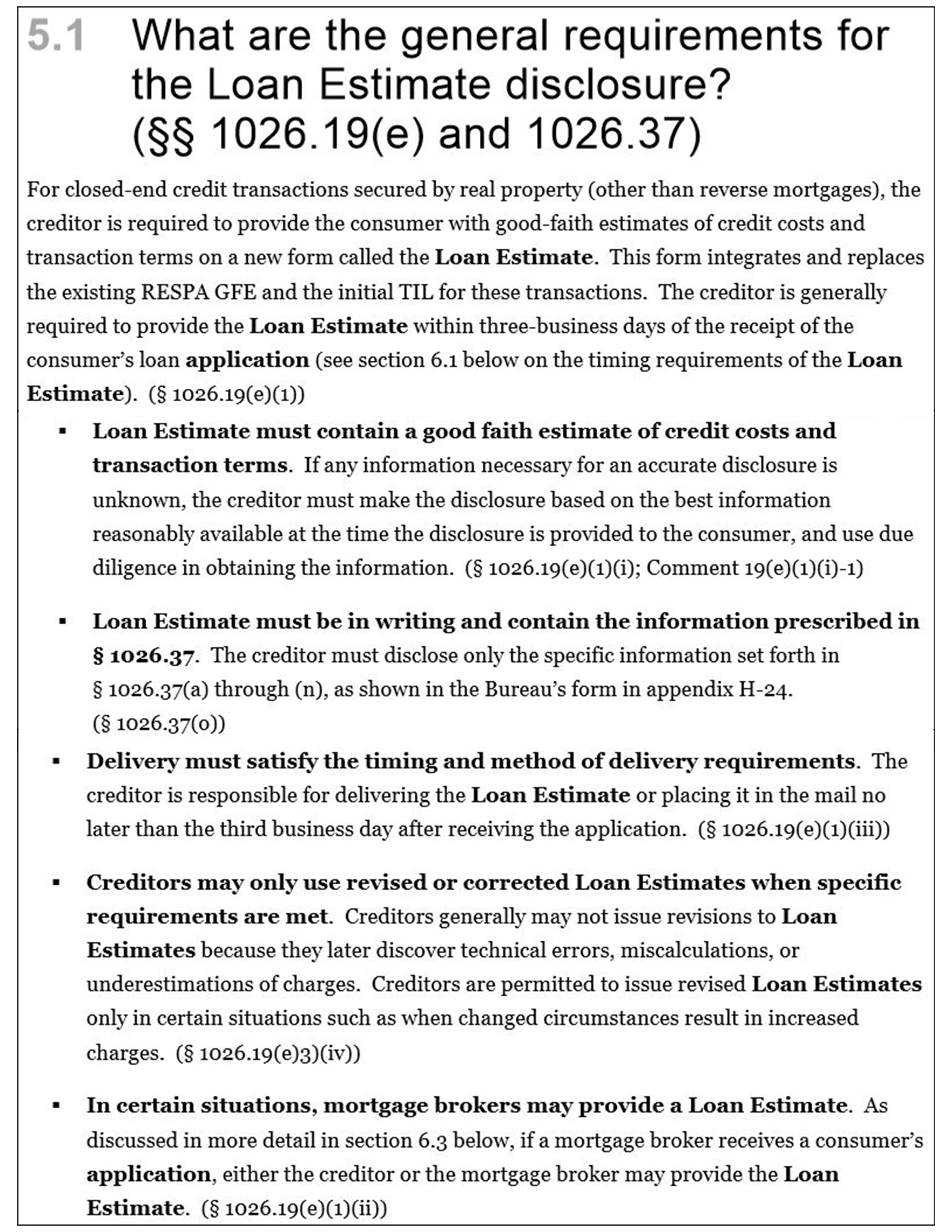

Check out what the CFPB has to say below or visit their site by clicking here: