TAMPA, FLA. – April 6, 2015 – Florida Agency Network, Florida’s largest network of independent title agencies, is proud to introduce Mike LaRosa, Esq., as the new Chief Operating Officer for the company.

“There have certainly been some milestones in our company and network that have been game changing. Having the caliber of person and operator like Mike LaRosa join us was never something we could have imagined years ago. Mike brings 16 years of industry experience and the operational expertise of running one of the largest title insurance underwriters to the Florida Agency Network. We are thrilled to have Mike join our growing family,” says Aaron M. Davis, CEO of the Florida Agency Network and its multiple brands, which include Hillsborough Title, Trident Title, Paramount Title, Tampa Bay Title, Cornerstone Title, HomePlus Title, Uptown Title, Bella Title, Performance Title & Escrow, and Progressive Title Solutions.

LaRosa graduated from the University of Florida with both his Bachelor’s degree and Juris Doctor degree in 1998. In 1999, LaRosa began his title insurance career with First American Title as Associate Counsel at the company’s divisional headquarters in Tallahassee. By 2000 he moved to Tampa to work with the Partnership Division, where he was promoted to Vice President and Counsel. He spent six years in the Partnership Division establishing affiliated business arrangement title agencies with mortgage, builder/developer, and real estate professionals throughout the Southeast.

In 2007 LaRosa was named Tampa Bay Agency Manager, and his territory was eventually expanded to include the entire southwest region of Florida. Ultimately he was promoted to Florida State Agency Manager where he has spent the past three and a half years. Throughout his career within First American he had the opportunity to speak at various industry functions, and he enjoyed the privilege of being selected to participate in the company’s specialized leadership training program geared at developing its internal leaders.

The Florida Agency Network is excited to have LaRosa onboard to help grow its statewide footprint while maintaining a strong, customer-service brand commitment to the community.

To read the full feature, click here.

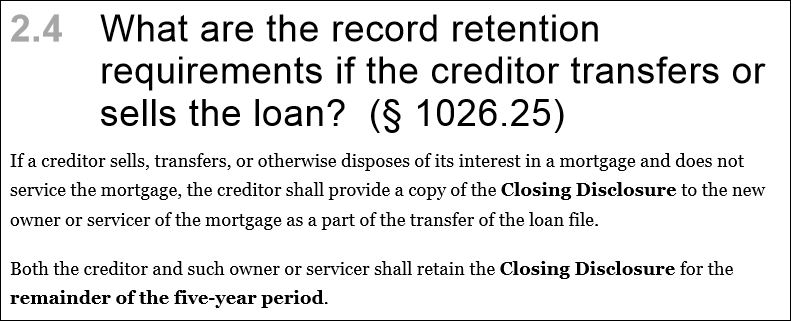

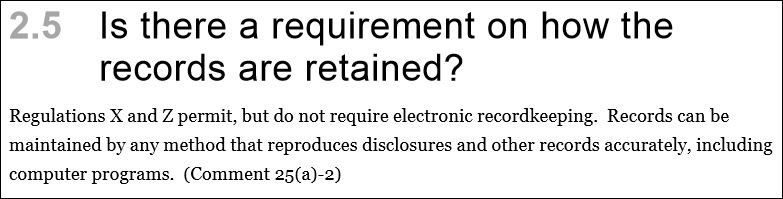

There are specific record retention requirements of the closing disclosure for the TILA-RESPA rule. Do your lending partners comply?

There are specific record retention requirements of the closing disclosure for the TILA-RESPA rule. Do your lending partners comply?