Recently, Aaron Davis had an article published on the ALTA website regarding the possibility of recent acquiring of title companies during a recent surge of mergers and acquisitions.

Below is a copy of the article, or ALTA members can read it here: https://bit.ly/34vg3h3

So You’ve Acquired a Title Business. Now What?

May 25, 2021 by Aaron Davis

It’s been an active year for mergers and acquisitions (M&A) in the settlement services space, to the surprise of nearly no one. 2020 was a year of record order volume for the title industry, leaving many firms flush with cash. While 2021 has been a year of opportunity in a rising purchase market, many economists forecast an imminent decline in refinance transactions. Regardless of what we’re currently seeing, it will be nearly impossible to repeat the historic spike seen last year. The likelihood is that 2021 will be very good—but not as good as 2020. Title agencies and settlement services firms will be forced to compete for market share.

This unusual turn sequence of events in the market has left many title companies facing some key strategic choices. More than a few, understanding that the market dynamic is shifting to one of increased competition, have plotted a course based on M&A: making strategic investments to increase their geographic and/or market footprints. Others, aware that, as good as 2021 may be, it won’t be 2020, are looking to sell high or “cash in.” It’s the perfect environment for M&A activity.

For the title agent or owner seeking to grow, the due diligence and valuation process is critical to the success of the strategy. But often overlooked in the larger process is what comes after the contracts are signed. For many, the real work begins once multiple offices and firms become one in name. A lot of thought, work and, yes, capital will still have to be injected into the process of integrating the new entity and positioning it to operate efficiently and profitably. What follows are a few of the things some acquiring businesses don’t always fully consider once they’ve received the proverbial keys to their new offices.

While the M&A due diligence process includes a pretty thorough review of the business being acquired, there are still aspects of the acquired business the new owner or owners may have to learn about after the ink on the contract has dried. The new owner is probably well aware of the production system being used and, if it’s a title agency, the underwriters they work with. But many times, the acquiring agent or owner doesn’t have a thorough understanding of the way that company does business at a granular level. For example, if the staff of an agency is used to handling the post-closing process for their own files, incorporating that title knowledgeable staff into a process-oriented business where the curative department only does curative while closers only do closings may be a challenge (although the thought of no longer having to handle post-closing might not be disagreeable to the new staff!). If the previous owner was an incredibly hands-on manager, a new owner who prefers to delegate or allow more freedom to a new staff could also, in some ways, provide a challenge as the two cultures blend.

Acquiring owners are likely very familiar with the geographical market or markets in which they operate their existing firms. But if the company and offices being acquired are outside of those familiar markets, those owners may need to rely on some of the professionals from the acquired companies as they acclimate to that new market. Anything from demographics or custom to, of course, regulatory differences can have a big impact on the way an acquiring firm does business day to day. It’s advisable to have a plan (and a contingency plan) that will acclimate the new owner and key personnel unfamiliar with the new market to the unique characteristics of that market. It could save a surprising amount of time, energy and, of course, money, in the long run.

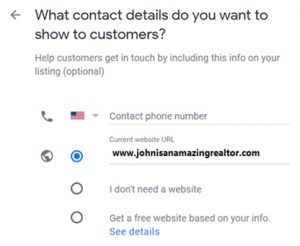

Acquiring owners may also believe they have performed adequate due diligence as to the technology and systems being inherited with the new offices. However, if the intention is to replace a production system with a different technology, those owners may be surprised by the need to keep at least one license for the system being replaced—and the cost. You see, existing clients will not care to again provide the sensitive data that will otherwise be lost in the archives of the old platform. Acquiring owners should plan to make a little investment in maintaining one license in order to have access to existing data for inherited customers.

In fact, one thing that seems to surprise a number of title business owners engaging in an M&A strategy is the investment required after the acquisition. The cost of training, tech integrations or outright replacement and even hiring or retraining often outpaces the conservative estimates of the acquiring owners. It’s also highly advisable to dig deeply into the hidden costs associated with the business acquired. Little things such as long-term contracts with 3rd party service providers or even copier leases can become unexpected costs when the acquiring owner seeks to change the way the little things are done. Another fairly common surprise may be the requirements of a pre-existing IT services or hosting contract, which could delay software installations or a full-on integration of the company-wide network or, even worse, lead to invoices for services that aren’t even being used.

Finally, there is the cost of time when integrating two office cultures. Acquiring owners should be prepared to spend time getting to know and understand the existing staff—unless they are planning the costly and time-consuming task of replacing them. It’s human nature for the professionals in an acquired business to be anxious about their job security. Some may even proactively begin to seek new employment elsewhere. A major mistake made by acquiring owners is to assume those employees can be quickly replaced (or integrated) without impacting that office’s production. The new owners who seem to have the smoothest integrations after acquisition are the ones who invest the time and resources into understanding—and being accessible to—the professionals associated with the acquired business.

Engaging in an M&A strategy is a proven means of successfully growing market share, which is imperative in a purchase market. But it’s not a given that simply making the acquisition will double or triple a business’ revenue and order volume. When insufficient planning and attention are given to the post-acquisition integration process, a merger or acquisition can have disastrous effects—right up to dragging the acquiring business itself into crisis. By taking the time and effort beforehand to carefully plot a post-acquisition strategy, the acquiring owner will be much more likely to reap the maximum benefits of the overall strategy.

Aaron Davis is chief executive officer of Florida Agency Network and AMD Enterprises.

Contact ALTA at 202-296-3671 or communications@alta.org.