All posts by Max

One More Reason to Attend!

Florida Agency Network is giving you one more reason to attend the 2015 Florida Realtors® Convention and Trade Expo! There are 36 reasons to attend.

The number one reason is to get up to date on everything TRID before the new disclosures go into effect October 3. Stop by booth 625 – Get social with all of the agencies in the FAN network and enter to win an Apple Watch!

Timeline > Consumer Financial Protection Bureau

Source: Timeline > Consumer Financial Protection Bureau

Timeline

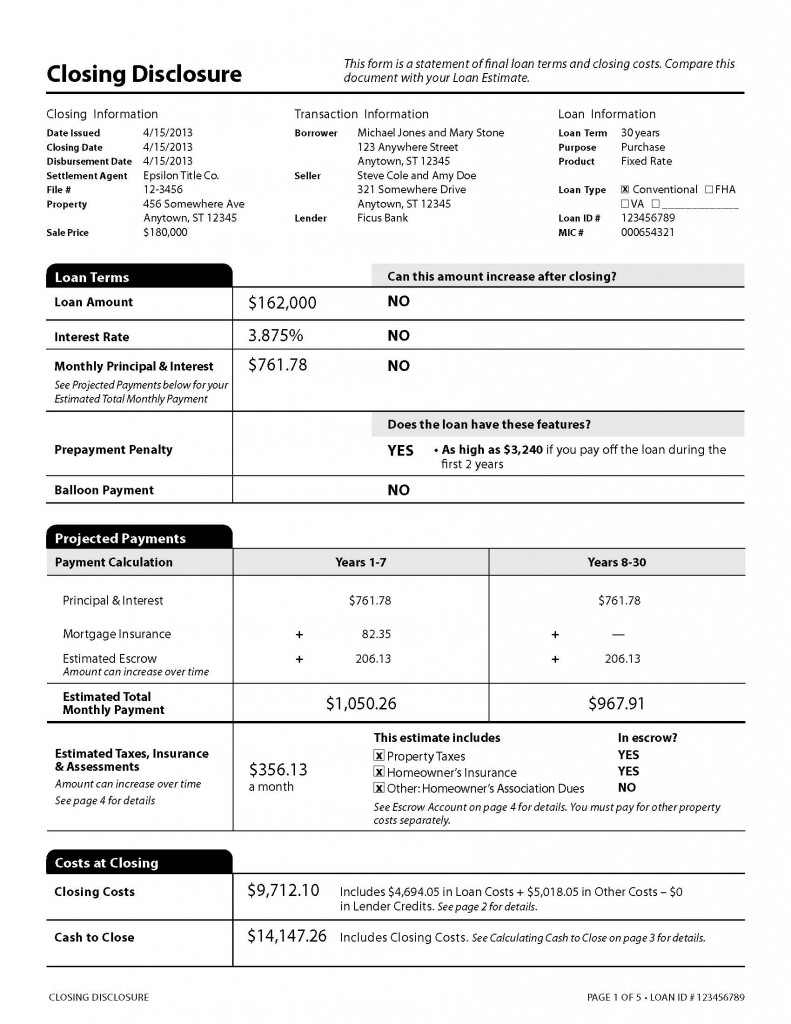

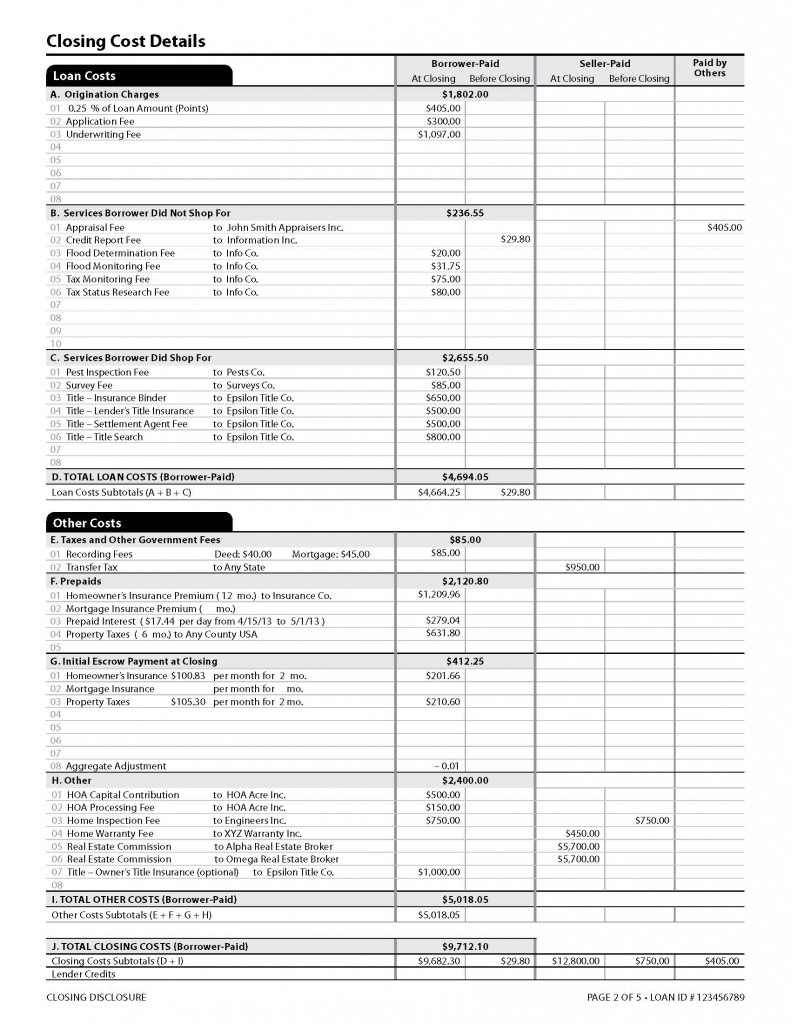

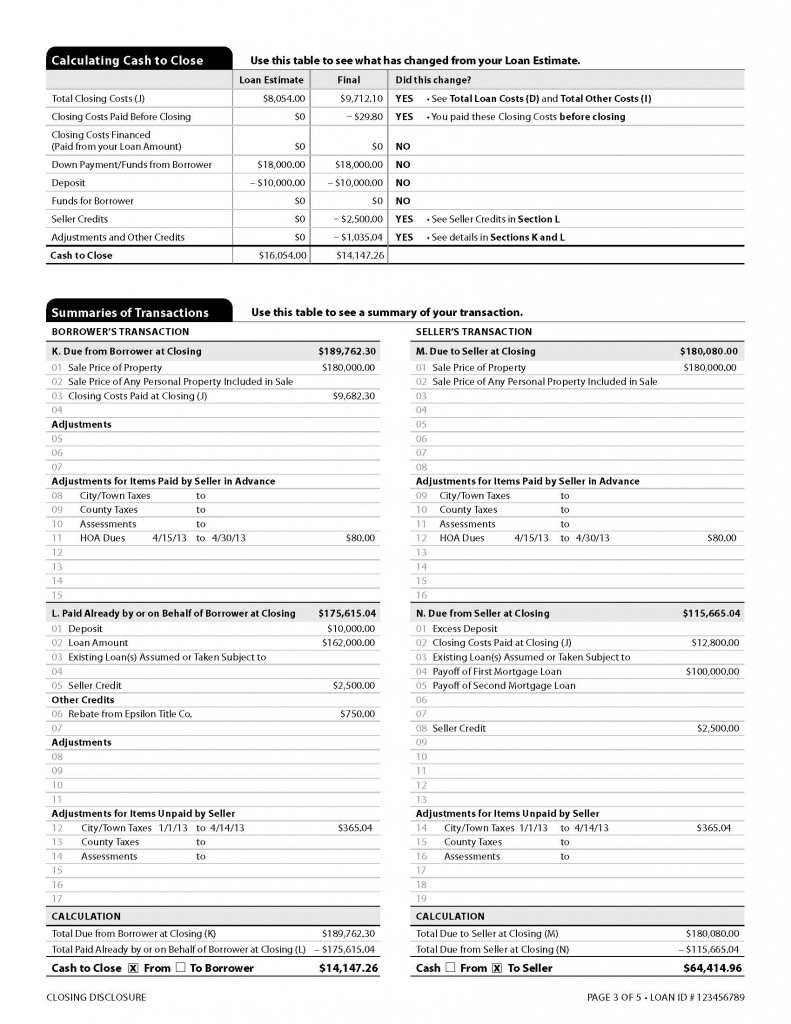

Here’s a full timeline of how we created the Loan Estimate and Closing Disclosure forms, part of our Know Before You Owe: Mortgages project. It’s a look back at our effort to make mortgage disclosures simpler and more effective, with the input of the people who will actually use them.

You can also return to the main page to view an interactive timeline.

The Dodd-Frank Wall Street Reform and Consumer Protection Act is signed into law.

The new law required the CFPB to combine the Truth in Lending and Real Estate Settlement Procedures Act disclosures.

The Treasury Department hosts a mortgage disclosure symposium.

The event brought together consumer advocates, industry, marketers, and more to discuss CFPB implementation of the combined disclosures.

Design begins.

Starting with the legal requirements and the consumer in mind, we began sketching prototype forms for testing.

During this process, the team discussed preliminary issues and ideas about mortgage disclosures. This session set the context for the disclosures and was a starting point for their development. The team continued to develop these issues and ideas over more than a year during the development process.

Know Before You Owe opens online.

We posted the first two prototype loan estimates. We asked consumers and industry to examine them and tell us what worked and what didn’t. We repeated this process for several future rounds. Over the course of the next ten months, people submitted more than 27,000 comments.

Qualitative testing begins in Baltimore.

We sat down with consumers, lenders, and brokers to examine the first set of loan estimate prototypes to test two different graphic design approaches.

Disclosures tested:

Los Angeles, CA

Consumers and industry participants worked with prototypes with lump sum closing costs and prototypes with itemized closing costs.

Disclosures tested:

Chicago, IL

Again, we asked testing participants to work with prototypes with lump sum closing costs and itemized closing costs.

Disclosures tested:

Springfield, MA

Another round of closing cost tests, as we presented participants with one disclosure that had the two-column design from previous rounds and another that used new graphic presentations of the costs.

Disclosures tested:

Albuquerque, NM

In this round, we presented closing costs in the itemized format and worked on a table that shows how payments change over time.

Disclosures tested:

Des Moines, IA

We began testing closing disclosures. Both designs included HUD-1-style numbering for closing details, but two different ways of presenting other costs and Truth in Lending information.

Disclosures tested:

Birmingham, AL

One form continued to use the HUD-1 style numbered closing cost details; the other was formatted more like the Loan Estimate, carrying over the Cash to Close table and no line numbers.

Disclosures tested:

Philadelphia, PA

In this round, we settled on prototypes formatted like the Loan Estimate, but one included line numbers and the other didn’t. We also began testing the Loan Estimate with the Closing Disclosure.

Disclosures tested:

Prototype A

Prototype B

Prototype C

Austin, TX

Participants reviewed one Loan Estimate and one Closing Disclosure (with line numbers) to see how well they worked together.

Disclosures tested:

We convene a small business review panel.

A panel of representatives from the CFPB, the Small Business Administration (SBA), and the Office of Management and Budget (OMB) considered the potential impact of the proposals under consideration on small businesses that will provide the mortgage disclosures.

We meet with small businesses.

The panel met with small businesses and asked for their feedback on the impacts of various proposals the CFPB is considering. This feedback is summarized in the panel’s report.

(Note: Link to large PDF file.)

Back to Baltimore!

We conducted one final round of testing to confirm that some modifications from the last round work for consumers.

Disclosures tested:

Prototype A

Prototype B

Prototype C

Proposal of the new rule.

The CFPB released a Notice of Proposed Rulemaking. The notice proposed a new rule to implement the combined mortgage disclosures and requested your comments on the proposal.

Comment period on most of the proposed rule closes.

Between the public comment period and other information for the record, the CFPB reviewed nearly 3,000 comments. These comments helped us improve the disclosures and the final rule.

We test Spanish language versions of the disclosures across the country.

We conducted qualitative consumer testing on Spanish language versions of the proposed disclosures. We tested in three cities: Arlington, Va. (October 11-12); Phoenix, Az. (November 14-15); and Miami, Fla. (December 12-13).

Validating our testing

With the help of Kleimann Communication Group, the contractor who helped us throughout the testing process, we conducted a quantitative study of the new forms with 858 consumers in 20 locations across the country. By nearly every measure, the study showed that the new forms offer a statistically significant improvement over the existing forms.

Additional testing with modified disclosures

In response to comments, we developed and tested different versions of the disclosures for refinance loans, which we tested for three rounds. (In our last round, we tested a modification for both purchases and refinances.) We also did one more round of Spanish language testing for the refinance versions. The modified disclosures tested well and are the ones included in the final rule.

A final rule

The CFPB issues a Final Rule. The final rule creates new integrated mortgage disclosures and details the requirements for using them. The rule is effective for mortgage applications received starting August 1, 2015.

New Effective Date Proposed

New Effective Date Announced

The CFPB issues a final rule moving the effective date to October 3, 2015.

▶ Come Celebrate Success at the 2015 Florida Realtors® Convention

Bon Voyage HUD-1!!!

Come get social with us at booth 625 as we bid the HUD-1 farewell and cruise to the new disclosures.

Can I Get a HUD?

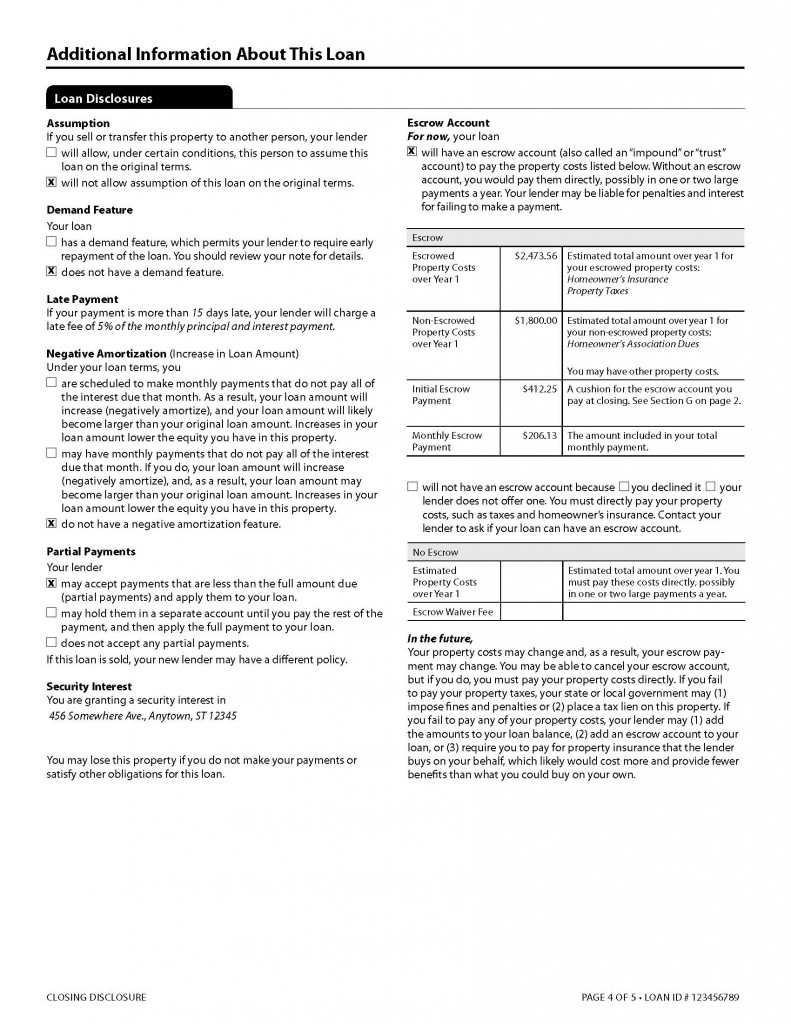

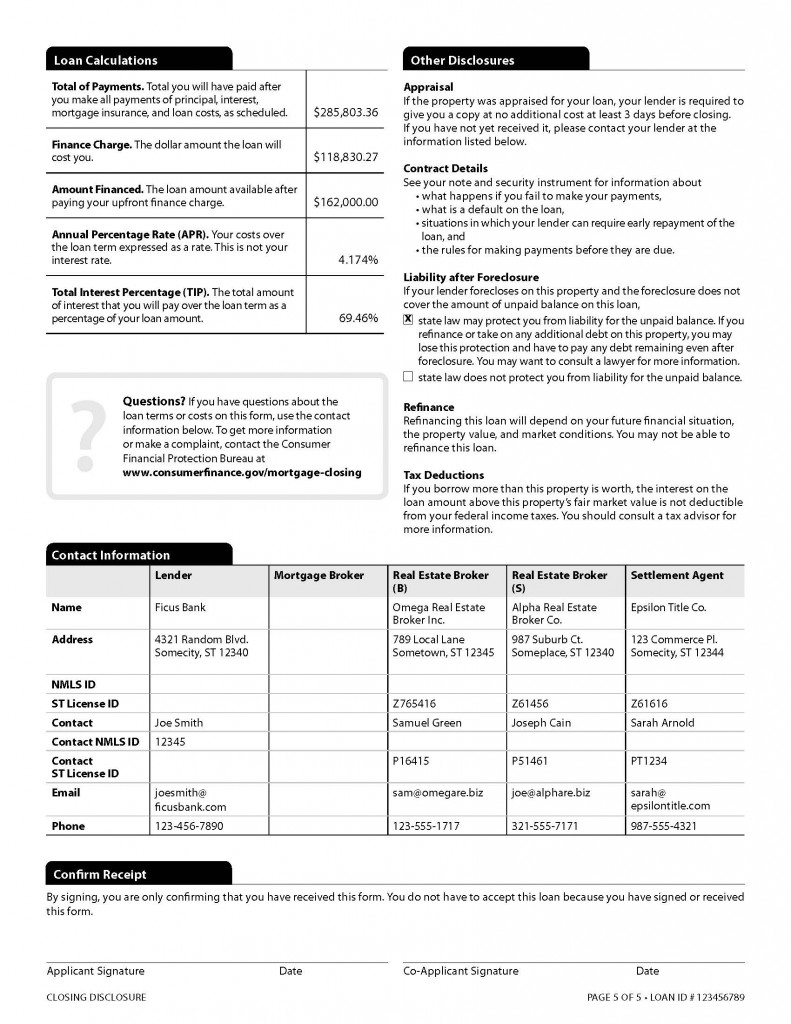

After October 3, 2015 you will no longer be receiving a HUD-1 settlement statement before consummation of a closed-end credit transaction secured by real property.

Say what?!?!

That’s right, I just said consummation of a closed-end credit transaction and no more HUD. There is new jargon to go along with the new, easy-to-read, consumer friendly, disclosures.

Bon Voyage HUD!

Take a peek at the new disclosures!

www.closing-disclosure.com

Stay Afloat Post-TRID

2015 Florida Realtors® Convention & Trade Expo

Each year, the Florida Realtors® Convention & Trade Expo gathers thousands of Realtors looking to up their game. This years theme is Celebration 15; the event falls on August 19-23 and is held at the Rosen Shingle Creek in Orlando, Florida. The free two-day Expo is on Thursday and Friday–all you have to do is register. There are over 30 education sessions sorted into six learning tracks–technology, broker, productivity, trends, personal growth, and continuing education. Along with the Convention, the Trade Expo has over 200 exhibitors that come packed with promotional materials and exquisite raffle prizes. This years keynote speaker is Notre Dame’s former Head Coach Lou Holtz.

On October 3, 2015 the TILA-RESPA Integrated Disclosure (TRID) rule will go into effect. The Florida Agency Network (FAN) is leading the industry through uncharted waters to the new disclosures. Title agencies in the FAN network are prepped and ready to keep you afloat before, during, and after these industry changes. Join us at booth 625 as we say Bon Voyage to the HUD-1 and celebrate the implementation of the new Closing Disclosure (CD). Get social with us and enter to win an Apple iWatch!

Consumer Financial Protection Bureau Finalizes Two-Month Extension of Know Before You Owe Effective Date

Washington, D.C. – The Consumer Financial Protection Bureau (CFPB) today issued a final rule moving the effective date of the Know Before You Owe mortgage disclosure rule, also called the TILA-RESPA Integrated Disclosures rule, to October 3, 2015. The rule requires easier-to-use mortgage disclosure forms that clearly lay out the terms of a mortgage for a homebuyer. The Bureau issued the change to correct an administrative error that would have delayed the effective date of the rule by at least two weeks, until August 15, at the earliest.

The Bureau is finalizing Saturday, October 3 as the effective date. The Bureau believes that moving the effective date may benefit both industry and consumers with a smoother transition to the new rule. The Bureau further believes that scheduling the effective date on a Saturday may facilitate implementation by giving industry time over the weekend to launch new systems configurations and to test systems. A Saturday launch is also consistent with industry plans tied to the original effective date of Saturday, August 1.

The final rule issued today also includes technical corrections to two provisions of the Know Before You Owe mortgage disclosure rule.

A copy of the final rule is available here: http://files.consumerfinance.gov/f/201507_cfpb_2013-integrated-mortgage-disclosures-rule-under-the-real-estate-settlement-procedures-act-regulation-x-and-the-truth-in-lending-act-regulation-z-and-amendments-delay-of-effective-date.pdf

Source: www.consumerfinance.gov