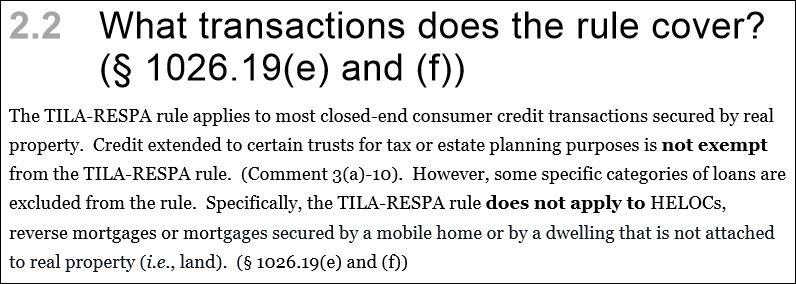

As it stands now, the CFPB has proposed the TILA-RESPA Integrated Disclosure (TRID) implementation date be postponed until October 3. The rule is open for public comment until July 7, 2015 leaving the industry grasping for some much needed clarity until a final rule gets locked down.

According to the Congressional Review Act (CRA), before any major new rule goes into effect Congress and the Government Accountability Office (GAO) must receive a rule report. It must contain a copy of the rule and be received at least 60 days prior to the rule taking effect. The CFPB’s failure to turn in this two-page report to Congress on time is the reason for this much appreciated delay.

Stay tuned as we keep you up to date and don’t forget, the best way to prepare yourself is to join the conversation. In an ever changing industry it is important to partner up with a title agency that has aligned and complied with the new regulations. Agencies powered by the Florida Agency Network (FAN) are prepped and ready to lead the way during this immense industry change.

Find out more about partnering with an agency in the network: