Stay on top of your game by familiarizing yourself with the general requirements that are going change in regards to the Good-Faith Estimate when the new TILA-RESPA Integrated Disclosure (TRID) rule goes into effect.

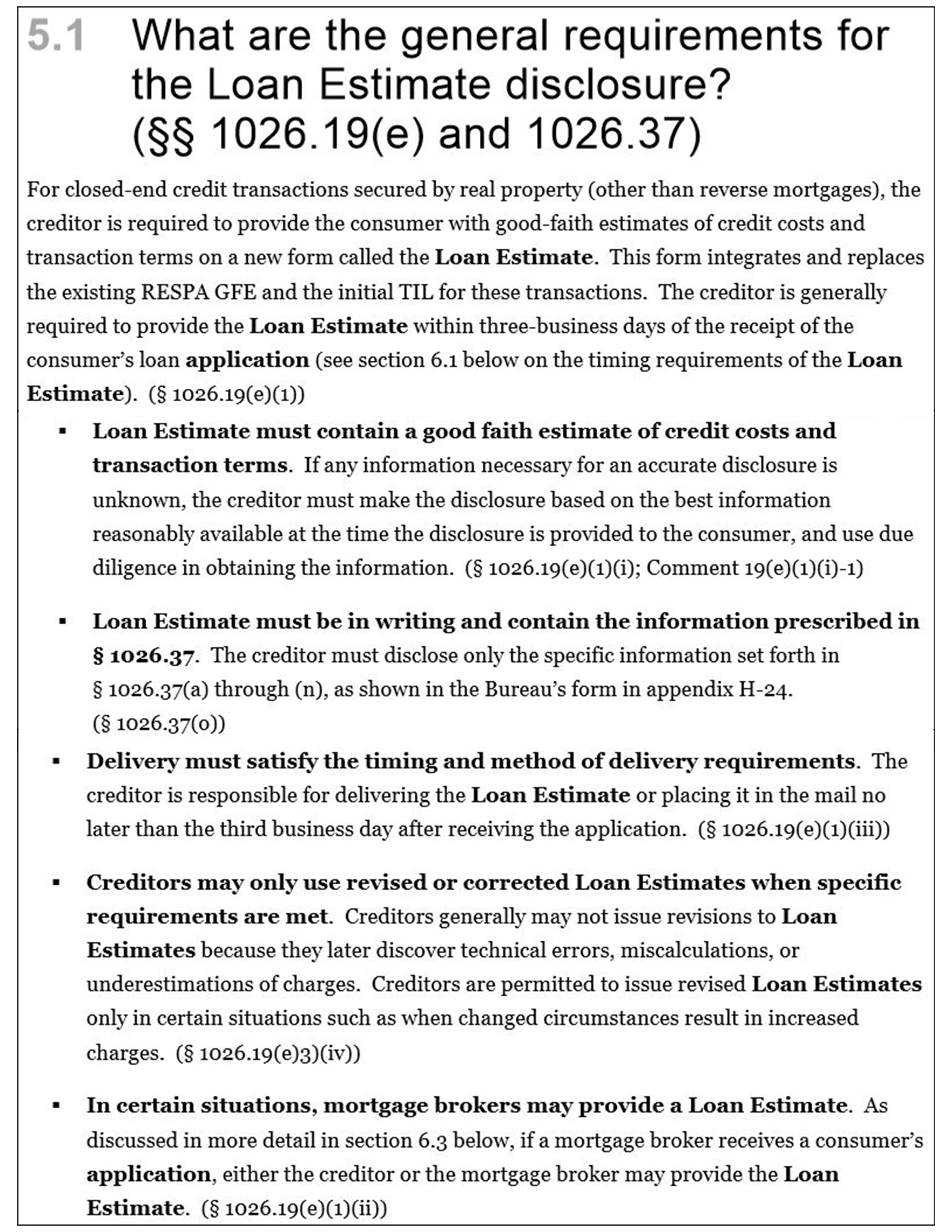

First of all, it is no longer going to be called a Good-Faith Estimate but will then be identified as a Loan Estimate.

Guess what?!?!

The jargon isn’t the only thing that is changing! The new disclosure carries with it some timing deadlines as well as a new look and lay out to the forms used instead of the familiar GFE.

The creditor, formally known as the lender, is required to provide all consumers of closed-end transactions secured by real property with a good-faith estimate of credit costs and transaction terms.

Mortgage brokers or creditors may provide the Loan Estimate to the consumer when the mortgage broker receives the consumer’s completed application and must be provided no later than 3 business days after the completed application has been turned in.

This new TILA-RESPA form integrates and replaces the current RESPA GFE and the initial TIL for these transaction types. Creditors must issue a revised Loan Estimate only in situations where changed circumstances resulted in increased charges.

These general requirement changes are meant to help better inform, protect and serve the consumer. The Florida Agency Network is ready to guide the industry through these changes and looks forward to partnering with you to streamline the process.

Schedule a Training Class