The industry’s much anticipated delay to implement the TILA-RESPA Integrated Disclosure (TRID) was announced last week. The new regulation had the initial launch date set to be August 1, 2015 but has now been pushed back later this year to October 1.

The Consumer Financial Protection Bureau’s Director, Richard Cordray stated, “We made this decision to correct an administrative error that we just discovered in meeting the requirements under federal law, which would have delayed the effective date of the rule by two weeks.” Whatever the reason the industry as a whole seems to have let out a huge sigh of relief.

These new documents are meant to be more consumer friendly by consolidating the TILA-RESPA forms and making them easier to understand. The new regulations give the consumer more time to review the total costs of their mortgage and to ask any questions they may have in regards to their loan terms. The Loan Estimate is due to consumers three days after they apply for a loan, and the Closing Disclosure is due three days before closing. These two requirements along with software compliance and security issues have thrown the industry into a frenzy as they try to comply by the deadline.

The best thing you can do to prepare yourself is to join the conversation. In an ever changing industry it is important to partner up with a title agency that has aligned and complied with the new regulations. Agencies powered by the Florida Agency Network (FAN) are prepped and ready to lead the way during this immense industry change. Tuesday, June 23, 2015 will mark the 100 day countdown until the CFPB’s implementation of the TRID.

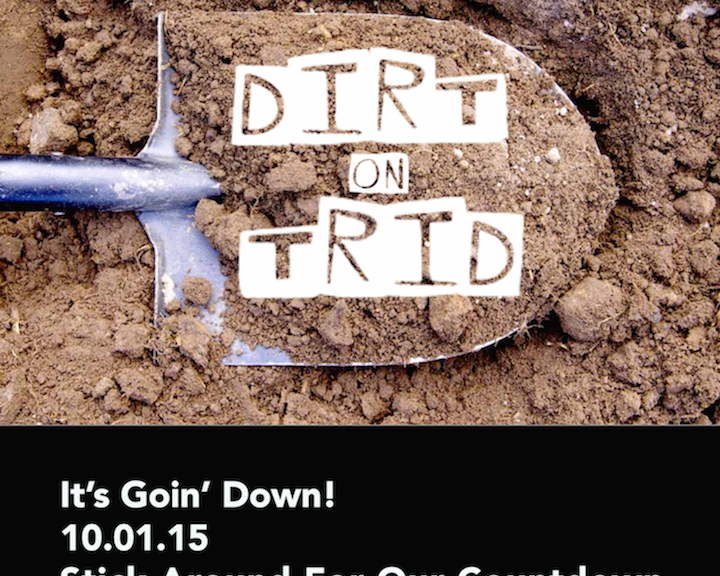

It’s going down — 10.01.15 — Stick around for our countdown!

Please Note: Since posting the CFPB has submitted an amendment to their proposal further delaying the effective date to October 3.