http://fwd5.wistia.com/medias/fwmynfenoy?embedType=iframe&videoFoam=true&videoWidth=640

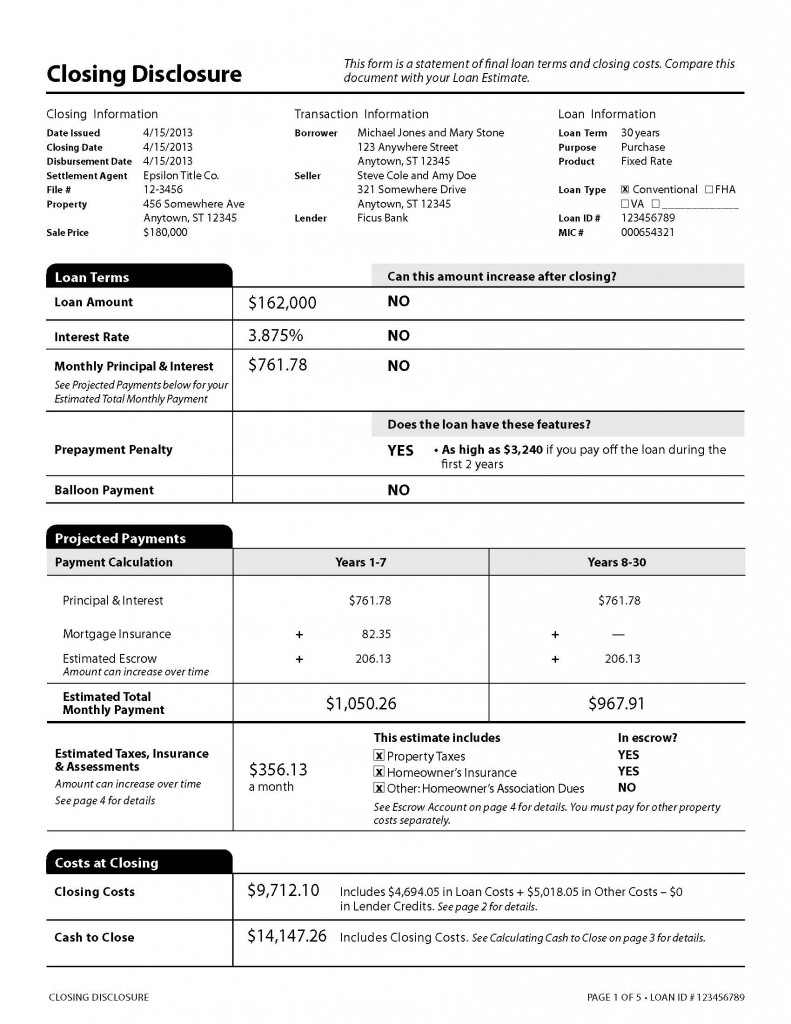

If your loan is approved, on the terms you requested the creditor is required to provide a Loan Estimate within 3 business days.

If they determine that your application will not or cannot be approved they do not have to provide a Loan Estimate.

Likewise, if you withdraw your loan application within that period they do not have to provide the Loan Estimate.

However, if the creditor does NOT supply the Loan Estimate in the required time approving and issuing the loan later under your original application terms will make them non-compliant with TRID Regulation Z.