Tampa, Florida – October 1, 2015 – The Florida Agency Network (FAN), Florida’s largest network of independent title agencies, is proud to announce it has completed a SOC 1 (Statement on Standards for Attestation Engagements No. 16 [“SSAE 16”]) Type 1 examination. The examination was performed by 360 Advanced, P.A., a full-service audit and consulting firm that specializes in integrated compliance solutions, including conducting SOC 1 examinations.

SSAE 16, developed by the American Institute of Certified Public Accountants (“AICPA”), is the most widely recognized authoritative guidance that provides service organizations a uniform method for disclosing independently assessed information about the design and operation of internal controls related to their services. Companies who complete an annual SOC 1 examination are able to demonstrate a substantially higher level of assurance and operationally visibility than those companies who do not.

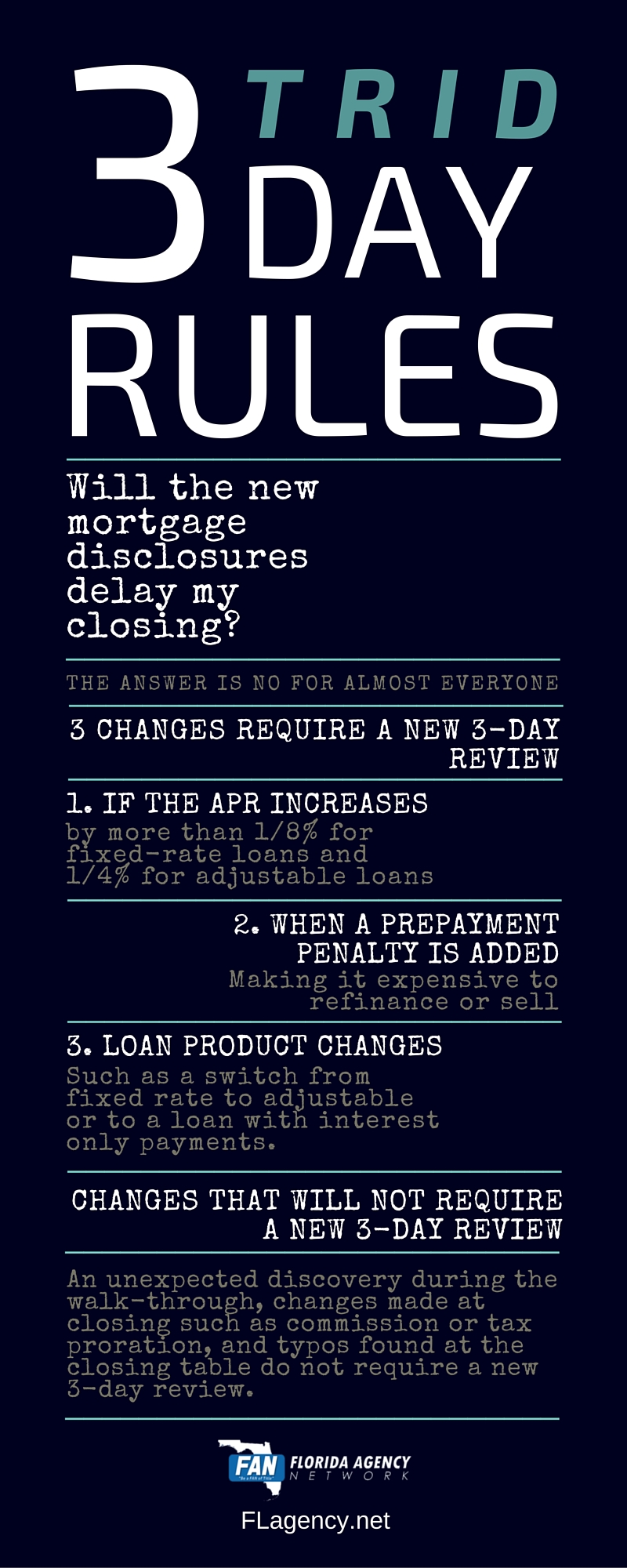

Securing SOC 1 Type 1 examination reinforces FAN’s, and its embodying agencies, commitment to security, confidentiality, availability, privacy and processing integrity by ensuring the highest quality and security of services provided to their customers. As the implementation of the TILA/RESPA reform is set to happen on October 3, 2015, many title companies have yet to complete the SOC 1 examination, leaving their stakeholders in a position to risk the exposure of non-public personal information (NPPI).

“We are proud to announce the completion of this major accomplishment. Very few in our industry can boast having a SOC 1 (SSAE 16). I think this portrays our level of commitment to the protection of data and NPPI (Non Public Private Information) to our real estate partners, and more importantly, to the consumer. Having gone through this rigorous assessment, we can provide certification and proof to our lenders and banks that the Florida Agency Network and its affiliates have taken its systems, procedures and control levels above and beyond what the industry has supplied in its Best Practices. Best Practices is simply the start, to get the industry moving in the right direction. SSAE 16 compliance is the next step, putting us on the same level as our banking and lending partners when it comes to compliance and protection.” says Aaron M. Davis, CEO of the Florida Agency Network and its multiple brands, which include Hillsborough Title, Trident Title, Paramount Title, Tampa Bay Title, Cornerstone Title, HomePlus Title, Uptown Title, Bella Title, Performance Title & Escrow, StrongHold Title and Progressive Title Solutions.

The FLORIDA AGENCY NETWORK (FAN) is the largest network of independent title agencies in the State of Florida. We have formed a strategic alliance to better serve our clients, allowing us to provide more services throughout the state. FAN offers convenient locations and many services that most title agencies do not provide, such as in-house legal counsel, in-house title plant, HOA estoppel ordering, dedicated REO department and much more.

Flagency.net