You’re doing it. You’re buying a house! Since the process can be overwhelming and confusing, we’ve simplified it in the best way possible. What better way to explain each step than to use GIFs from one of our favorite TV shows, The Office?

1. The Contract is Signed & Sent to the Title Insurance Agency

Congrats on finding “The One!” At this point, your real estate agent has drafted your official contract, and the title insurance agency is starting the closing process. You’re on your way to owning a new home!

2. Sending Your Earnest Money Deposit

Think of your earnest money deposit, or EMD, as a “good faith” deposit. It shows the listing agent and seller how serious you are about the home and getting the transaction closed. The dollar amount of your EMD is stated in your contract when it’s signed. Be sure to discuss what you’re comfortable putting upfront with your real estate agent. Depending on how much you agree on, it can seem like an expensive upfront cost. Your real estate agent is an expert and can advise you on the amount of money they think you should send. Take comfort in knowing the EMD will be held in your escrow account and used towards closing costs or the down payment.

3. Your Title Search is Ordered

Your title insurance agent will order a title search to ensure the title to your property is clear of any liens, back taxes, or other claims. To get a thorough search completed, ask your agent to request the title insurance company conduct a municipal lien search, permit search, and code enforcement search. With Florida Agency Network’s offices, we offer this to each buyer via the buyer’s agent.

4. Time to Schedule Your Home and Pest Inspection

Shortly after your offer is accepted and sent in, your agent will discuss scheduling a home inspection. You’ll need to complete the home inspection quickly. Doing so will allow as much additional time possible for any follow-up inspection.

5. The Title Commitment is Completed

You’re one step closer to closing on your home! The title commitment tells a buyer they’re able to obtain a title insurance policy with that agent. The commitment contains the terms, conditions, and exclusions that will be in the owner’s title insurance policy.

6. Appraisal is Completed

The home appraisal should come back at or above the contract price. The appraisal protects a buyer from paying more than the home is worth. If your home appraisal is lower than the purchase price, don’t worry! Discuss your options with your real estate agent.

7. You Get the Clear to Close

You’ll begin to see the light at the end of the tunnel once you and your agent receive the clear to close. “Clear to Close” means the underwriter has signed-off on all documents and issued final approval on your closing.

8. Your Closing Date is Scheduled

Once your closing date is scheduled, don’t forget to double-check for the required documents, identification, and time deadlines. The last thing you want is to forget to bring an item or sign an eDoc and have to reschedule your closing.

9. It’s Time for a Final Walkthrough

The final walkthrough is your opportunity to do one last visual inspection to make sure everything is in order. At this point, your closing starts moving much faster, and the finish line is right ahead!

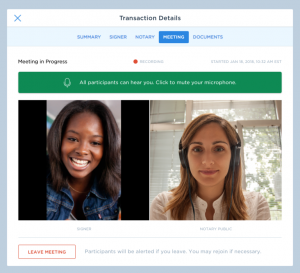

10. Signing Your Closing Docs

We hope you’re ready to sign, sign, and sign some more! While it may be exhausting and overwhelming, don’t be afraid to pause and ask questions. At the closing table, your title closer and real estate agent are available to answer any questions you may have. Don’t forget, this is your moment, and you can go as quickly or slowly as you prefer. You’re allowed to get ice cream afterward, too!

11. Receive Your Keys

You may or may not receive the keys to your new home at the closing table. In order to get those, the funds have to be wired to the seller. However, once they are received and confirmed, you have a new home!

You’re officially the owner of a new home, and we think that is Perfectenschlag!