http://fwd5.wistia.com/medias/hxthum9hb1?embedType=iframe&videoFoam=true&videoWidth=640

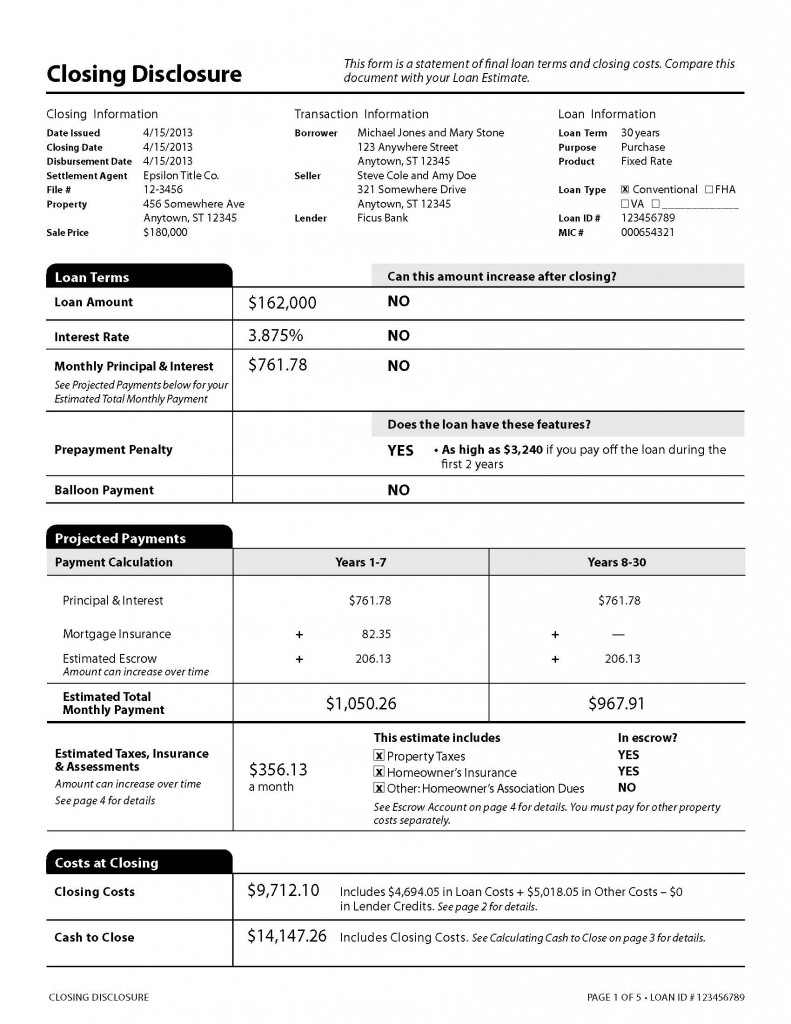

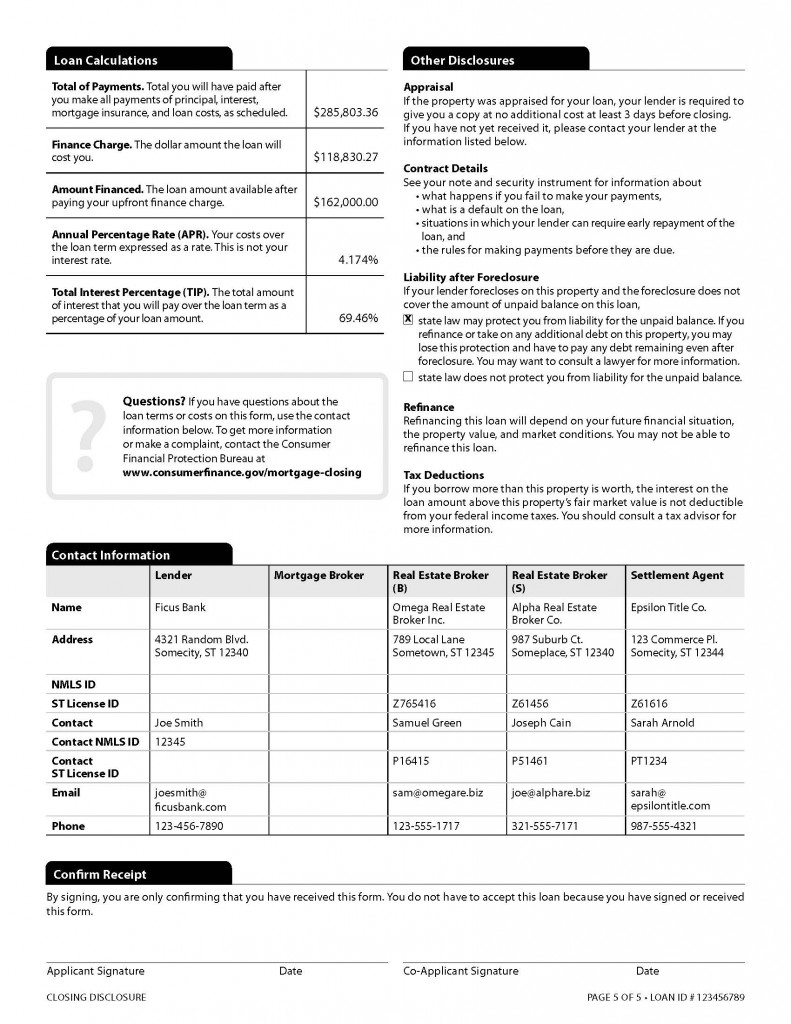

Under the TRID rule, creditors must retain Escrow Cancellation and Partial Payment Policy disclosures for two years; Loan Estimate records for three years after loan consummation and Closing Disclosures for FIVE years.

If a creditor sells or transfers their interest they must provide a copy of the Closing Disclosure to the new owner or servicer and both parties must retain it for the remainder of the 5-year period. Records CAN be stored digitally but it is NOT required.

TRID does not define how long consumers should keep disclosure records.