http://fwd5.wistia.com/medias/yqyii446cx?embedType=iframe&videoFoam=true&videoWidth=640

For both, as we show you in this video, compared with other options, with fixed rates, housing costs won’t be affected by interest rate changes and inflation.

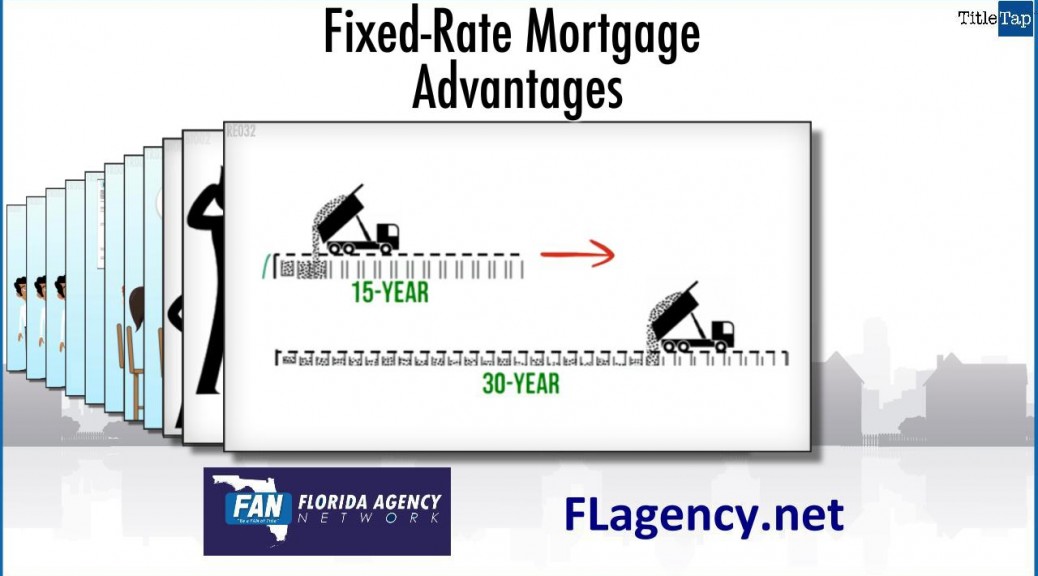

With A 30-Year Term: In the first 23 years of the loan more interest is paid off than principal meaning larger tax deductions. As inflation and costs of living increase mortgage payments become a smaller part of overall expenses.

With A 15-year Term: Loan is usually made at a lower interest rate. Equity is built faster because early payments pay more principal. And the loan is paid off earlier.

Compare payments, principal and interest totals to make a decision.